Cookies!

Cookies!

-

Categories

- ATI

- NR

- OCR GCSE Papers & ma...

- AQA papers mark sche...

- Relias Dysrhythmia

- OCR GCE A & AS LEVE...

- OCR GCSE Question Pa...

- Pearson Edexcel A an...

- EXAM

- Summary

- Study Notes

- QUESTION PAPER (QP)

- QUESTIONS & ANSWERS

- CASE STUDY

- Class Notes

- ESSAY

- Presentation

- Report

- Judgements

- Manual

- Summary

- STUDY GUIDE

- Thesis

- Visual

- Text Book Notes

- BUSINESS PLAN

- Syllabus

- LECTURE NOTES

- E-Book

- EXAM PROCTORED

- NCLEX-PN

- NCLEX-RN

- ORDER CUSTOM PAPER H...

- Dissertation

- Research Paper

- DISCUSSION POST

- Final Exam Review

- EXAM REVIEW

- SOAP NOTE

- iHuman

- SHADOW HEALTH

- TEST BANK

- MILESTONE

- HESI

- ATI MEDICAL SURGICAL

- QUESTIONS and ANSWER...

- SOPHIA PATHWAY

- MED-SURG EXAM

- HESI MED SURG

- UWorld

- Lab Experiment

- Lab Report

- Experiment

- NCLEX

- PATIENT ASSESSMENTS

- JOURNAL

- SOPHIA Milestone

- VSIM for NURSING FUN...

- PROJECT FINAL

- CAPSTONE SIMULATION

- VATI RN

- VATI PN

- Portfolio

- GIZMOS

- Solutions Guide

- SOLUTIONS MANUAL

- vSim For Nursing

- SWIFT RIVER

- MARK SCHEME

- Virtual Clinical Exp...

- AQA

- AQA Questions and Ma...

- Higher Education

- Edexcel

- INSTRUCTOR MANUALS

- ATI

- Advanced Trauma Life...

- GUIDELINES

- INTERVIEW

- Object-Oriented Prog...

- AS Mark Scheme

- A-Level Mark Scheme

- ANSWERS AND COMMENTA...

- GCSE MARK SCHEME

- GCSE QUESTION PAPER

- AQA Question Papers

- A/As Level Mark Sche...

- AS Level Mark Scheme

- RESOURCE BOOKLET

- Edexcel Question Pap...

- QUESTION PAPER & MAR...

- Test Prep

- LAB QUIZ

- Quiz

- PREDICTED PAPER

- IGCSE

- Examiners’ Report

- SPECIMEN INSERT

- INSERT CONTENT PAPER

- AQA A/As Level Quest...

- As Level Question Pa...

- Cambridge Internatio...

- Cambridge IGCSE QP

- Cambridge IGCSE MS

- BTEC Nationals

- Edexcel Mark Scheme

- A Level Question Pap...

- AS Level Question Pa...

- CHEAT SHEET

- Capism

- FISDAP

- AHIP

- Feedback Log

- Book Review

- FILM REVIEW

- POEM ANALYSIS

- SUMMARY

- PLAY ANALYSIS

- MOVIE ANALYSIS/REVIE...

- SAT

- LSAT

- MCAT

- TOEFL

- IELTS

- Textual Analysis

- Annotated Bibliograp...

- CODING SOLUTION

- Literature

- COURSE NOTES

- ASSIGNMENT

- PROJECT REPORT

- SOLUTIONS

- EXAM/TEST TEMPLATE

- TEMPLATE

- HOMEWORK

- WORKSHEET

- TEST PREP

- English Literature

- FINAL EXAM

- HESI A2

- APEA

- CAPSTONE

- SIMULATION

- PROGRAMMING

- HTML

- USMLE

- HARVARD CASE SOLUTIO...

- CASE SOLUTIONS

- Exam (elaborations)

- Answers

- Other

- Textbook notes

- Case

- TEST BANKS

- AMLS

- A Level & AS Level N...

- Exam Elaborations

- NRNP

- WGU C214

- Straighterline

- NBME

- NSG

- AQA 2023

- AQA GCSE QUESTION PA...

- Prophecy Pacu

- Prophecy Medical Sur...

- Prophecy RN

- TNCC

- WGU C215

- Texas All Line

- Rasmussen Pharmacolo...

- AQA Papers & Mark Sc...

- EMT BLOCK

- PAX

- EXCEL CRASH COURSE

- EMT FISDAP

- ATI Dosage Calculati...

- APEX

- TMC

- OCR GCSE

- Wonderlic

- VATI

- ANCC

- Smart Serve

- WGU C428

- AQA GCSE COMBINED SC...

- OCR PAPERS & MARK SC...

- NAPRx

- NUTRITION 101

- WGU C207

- USPS

- Support

- Cart {{ cart.length }}

- Account

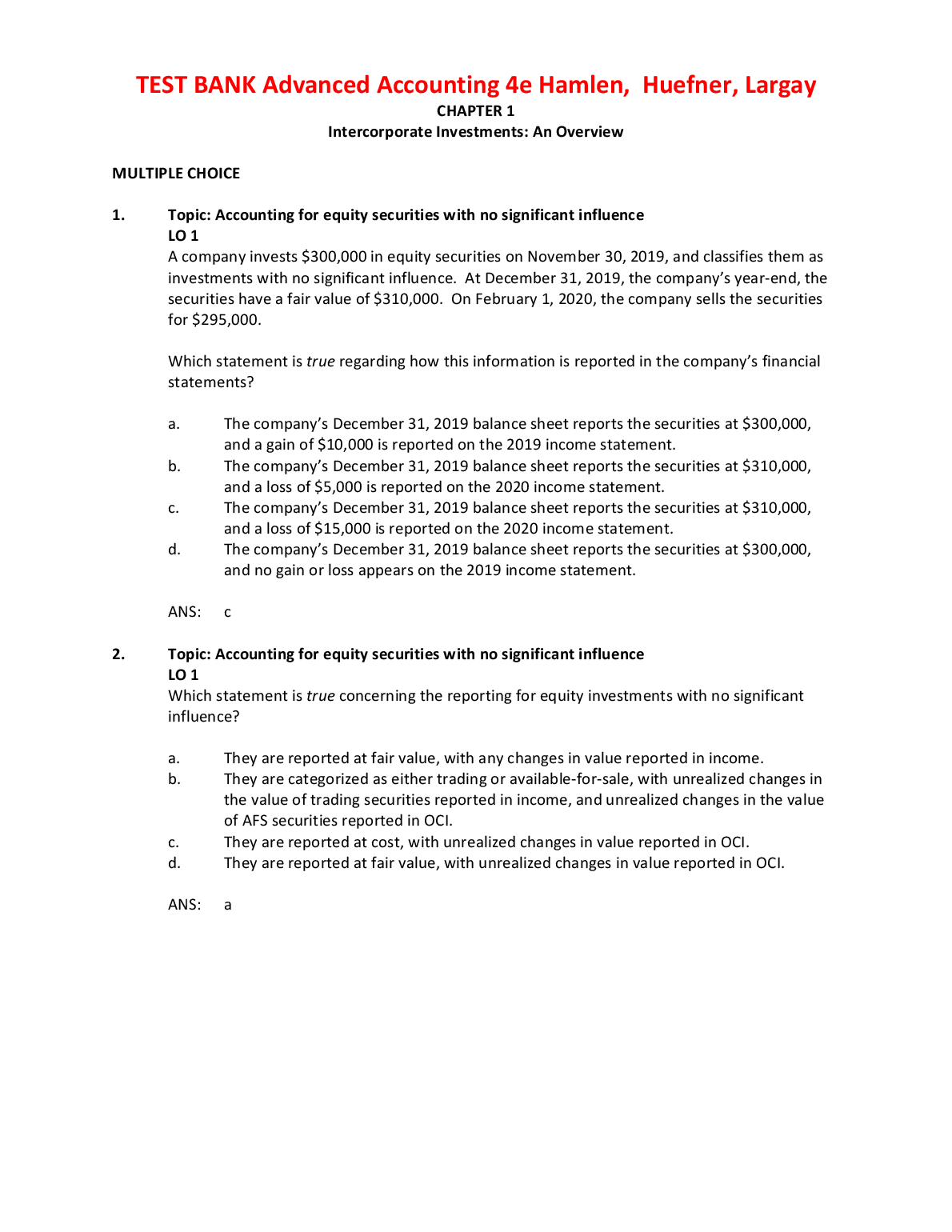

Topic: Accounting for equity securitie...

View example

View example

Topic: Accounting for equity securities with no significant influence

LO 1

A company invests $300,000 in equity securities on November 30, 2019, and classifies them as

investments with no significant influence. At December 31, 2019, the company’s year-end, the

securities have a fair value of $310,000. On February 1, 2020, the company sells the securities

for $295,000.

Which statement is true regarding how this information is reported in the company’s financial

statements?

a. The company’s December 31, 2019 balance sheet reports the securities at $300,000,

and a gain of $10,000 is reported on the 2019 income statement.

b. The company’s December 31, 2019 balance sheet reports the securities at $310,000,

and a loss of $5,000 is reported on the 2020 income statement.

c. The company’s December 31, 2019 balance sheet reports the securities at $310,000,

and a loss of $15,000 is reported on the 2020 income statement.

d. The company’s December 31, 2019 balance sheet reports the securities at $300,000,

and no gain or loss appears on the 2019 income statement.

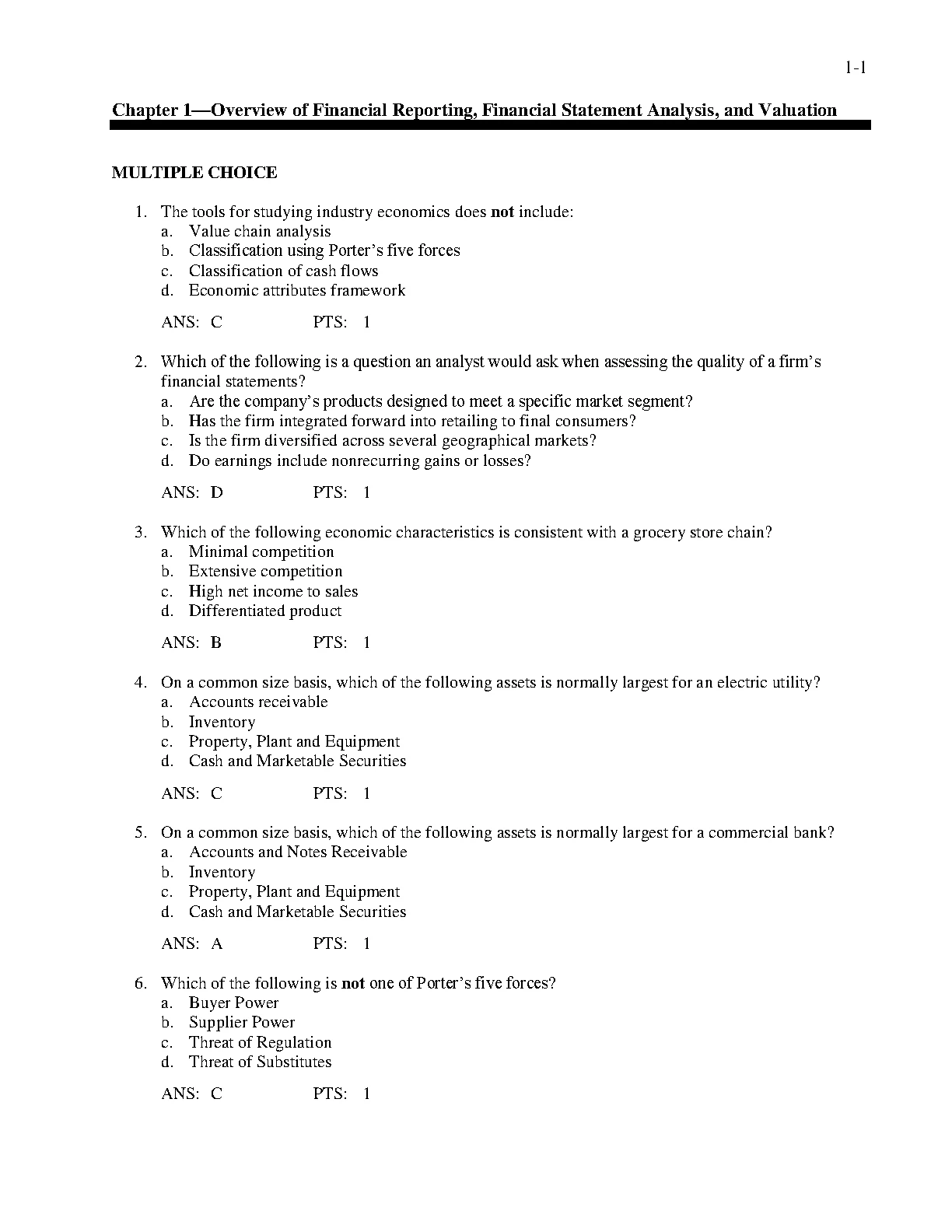

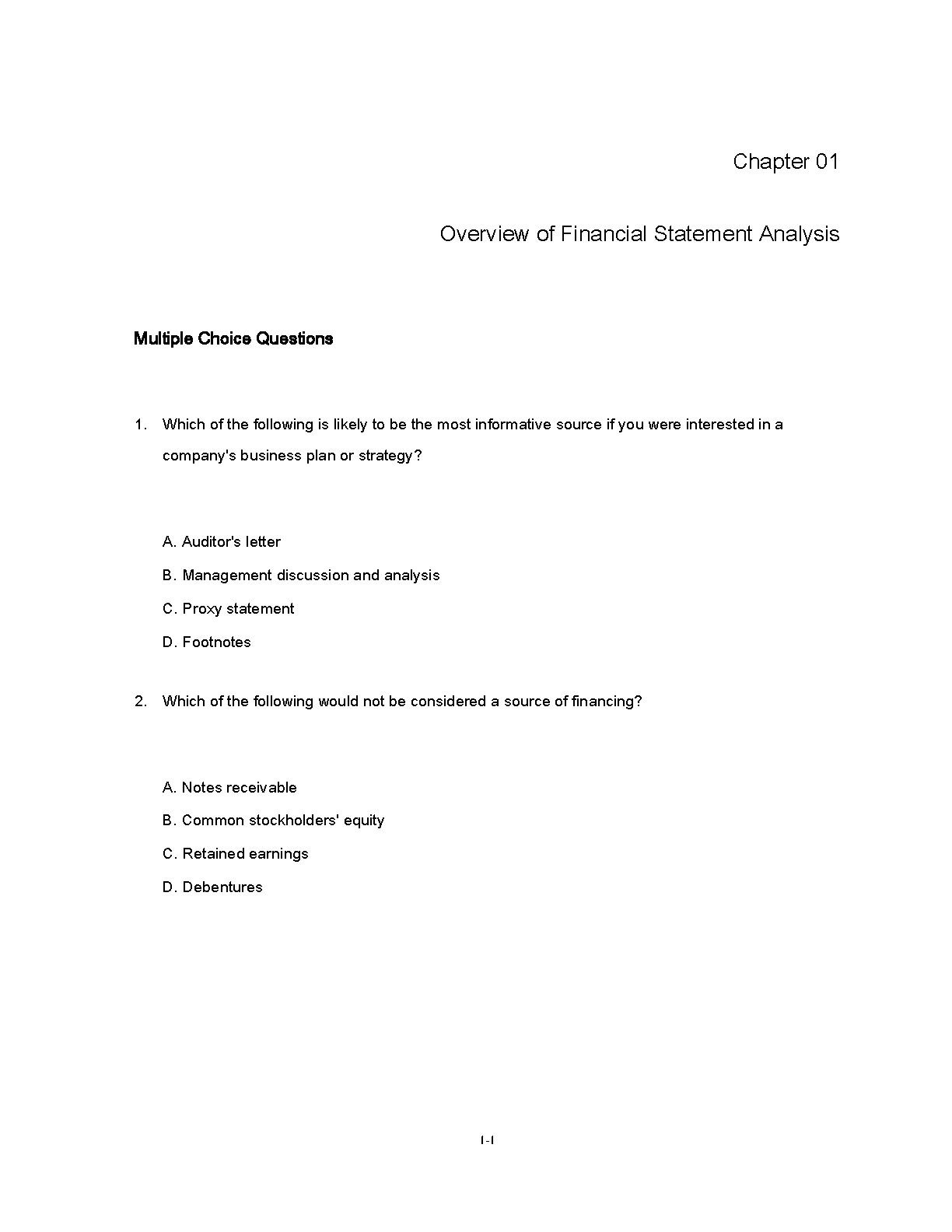

Financial Reporting Financial Statement Analysis a...

2024 Financial Statement Analysis 11e Latest solut...

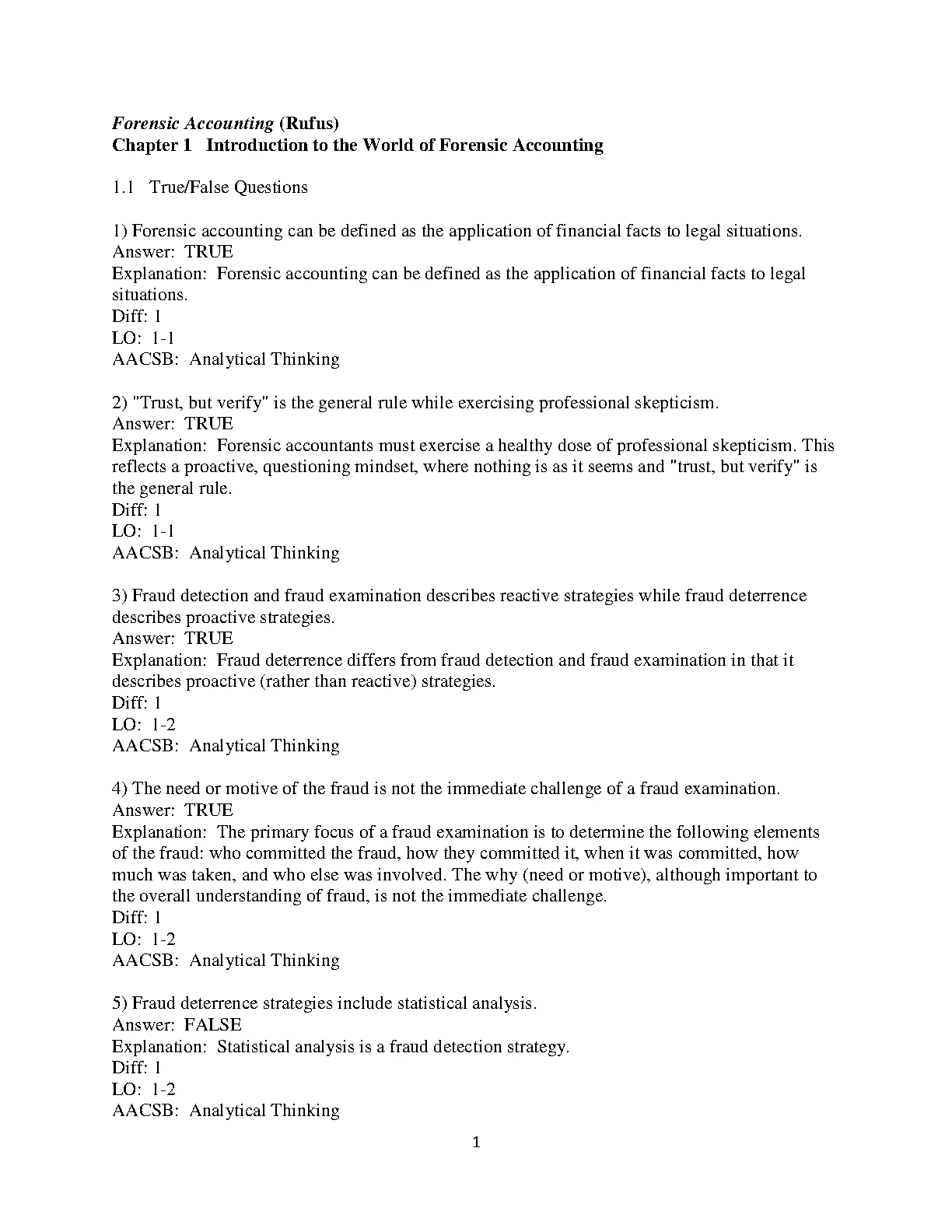

2024 Forensic Accounting 1e Robert Rufus Laura Mil...

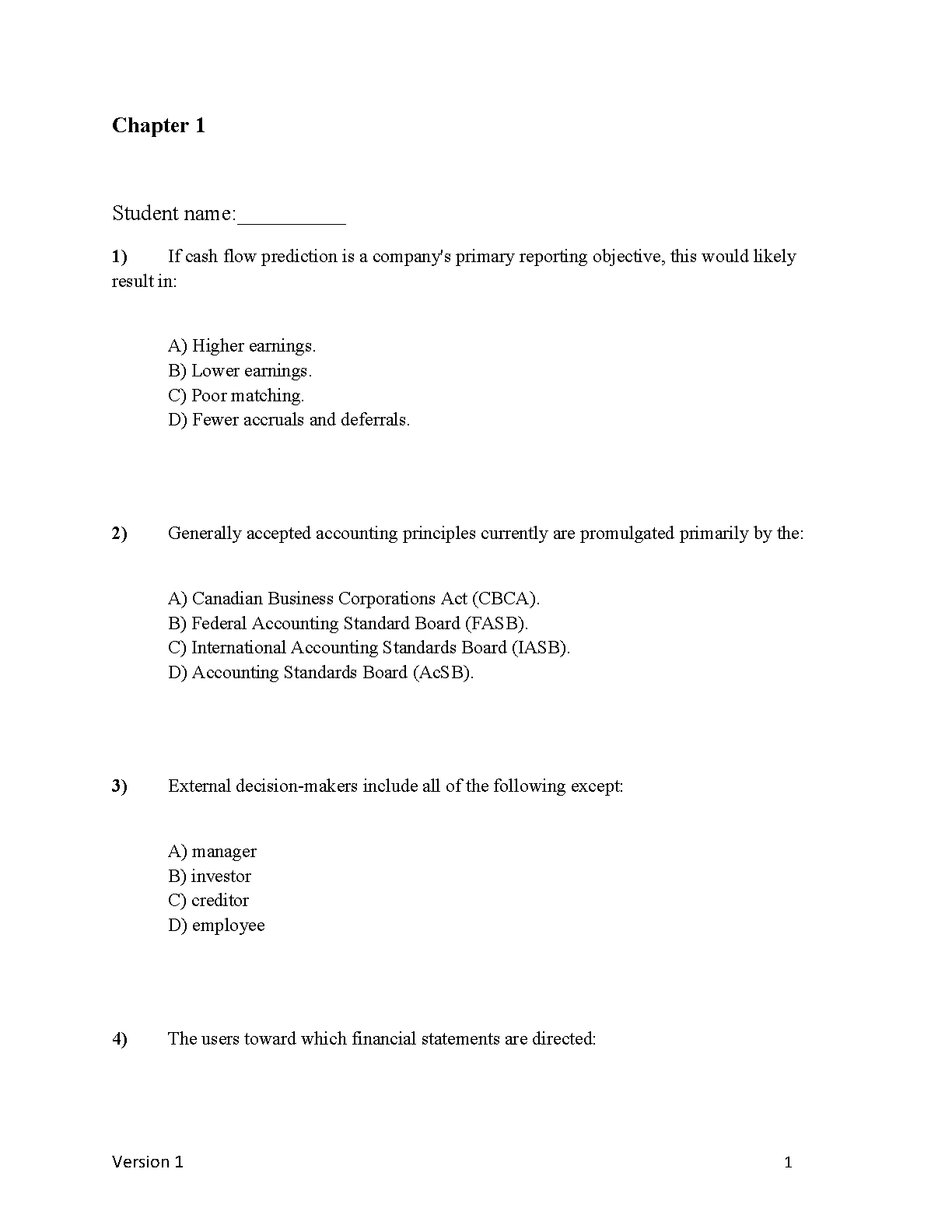

Intermediate Accounting (Volume 1) 2024, 8th Canad...

Intermediate Accounting, 3e Elizabeth Gordon, Jana...

Hospitality Industry Financial Accounting 4e Raymo...

TEST BANK for Nuclear Systems Volume 1: Thermal Hy...

Lewis's Medical-Surgical Nursing, Mariann M. Hardi...

Nursing The Art and Science of Person-Centered Car...

Test Bank for Operations Management 11th Edition B...

Cookies!

Cookies!